Mortgage Calculator: Plan Your Loan with Confidence

A mortgage calculator is an essential tool for anyone considering a home purchase or refinancing. It helps you estimate monthly payments, understand interest costs, and plan your budget effectively. In this comprehensive guide, we’ll explain how a mortgage calculator works, provide the formula, and offer tips for managing your home loan. Perfect for first-time buyers or seasoned homeowners, this article is your go-to resource for mastering mortgage calculations.

What is a Mortgage Calculator?

A mortgage calculator is an online or manual tool that estimates your monthly mortgage payments based on key inputs like loan amount, interest rate, and loan term. It can also show how much interest you’ll pay over the life of the loan and help you compare different mortgage scenarios.

Why Use a Mortgage Calculator?

Using a mortgage calculator offers several benefits:

-

- Budget Planning: Determine affordable monthly payments.

-

- Loan Comparison: Evaluate fixed vs. adjustable-rate mortgages or different terms.

-

- Cost Transparency: Understand total interest and loan costs.

-

- Financial Confidence: Make informed decisions before committing to a loan.

Whether you’re buying your dream home or refinancing, a mortgage calculator simplifies complex numbers into actionable insights.

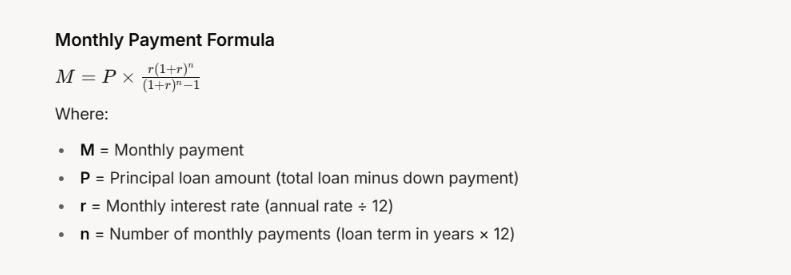

Mortgage Calculator Formula

The formula for calculating a monthly mortgage payment is based on an amortization schedule, which spreads the loan repayment over time. Here’s the standard formula:

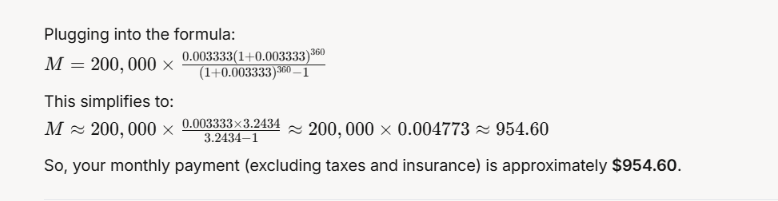

Example Calculation

Let’s say you borrow $200,000 at a 4% annual interest rate for a 30-year fixed mortgage.

-

- Principal (P): $200,000

-

- Monthly interest rate (r): 4% ÷ 12 = 0.04 ÷ 12 = 0.003333

-

- Number of payments (n): 30 years × 12 = 360 months

What Does a Mortgage Payment Include?

A mortgage payment typically consists of four components, often referred to as PITI:

-

- Principal: The portion of the loan you’re paying back.

-

- Interest: The cost of borrowing, based on the interest rate.

-

- Taxes: Property taxes, often escrowed and paid by the lender.

-

- Insurance: Homeowners insurance and possibly mortgage insurance (if your down payment is less than 20%).

A mortgage calculator may include taxes and insurance if you provide those details, giving a more accurate monthly cost.

How to Use a Mortgage Calculator

Using a mortgage calculator is simple, whether online or manual. Follow these steps:

-

- Gather Information:

-

- Loan amount (home price minus down payment)

-

- Interest rate (fixed or adjustable)

-

- Loan term (e.g., 15, 20, or 30 years)

-

- Optional: Property taxes, insurance, and HOA fees

-

- Gather Information:

-

- Input Data: Enter the values into an online calculator or use the formula above.

-

- Review Results: Check monthly payments, total interest, and amortization details.

-

- Adjust Scenarios: Test different loan amounts, rates, or terms to find the best fit.

-

- Plan Ahead: Use the results to set a realistic budget and discuss options with your lender.

Tips for Managing Your Mortgage

To make your mortgage work for your financial goals, consider these strategies:

-

- Shop Around: Compare rates from multiple lenders to secure the best deal.

-

- Make Extra Payments: Paying more toward the principal can reduce interest and shorten the loan term.

-

- Refinance Wisely: If rates drop, refinancing could lower your payments (but factor in closing costs).

-

- Budget for Extras: Account for taxes, insurance, and maintenance in your homeownership budget.

-

- Consult Experts: Work with a mortgage broker or financial advisor for personalized guidance.

FAQs About Mortgage Calculators

1. Can a mortgage calculator include property taxes?

Yes, many online calculators let you input taxes and insurance for a complete payment estimate.

2. How accurate are mortgage calculators?

They’re highly accurate for estimates but may not account for fluctuating rates or lender-specific fees.

3. Should I choose a 15-year or 30-year mortgage?

A 15-year mortgage saves on interest but has higher monthly payments. A 30-year term offers lower payments but costs more overall. Use a calculator to compare.

Why Use a Mortgage Calculator?

A mortgage calculator empowers you to plan one of life’s biggest financial decisions with clarity. By understanding your payments and long-term costs, you can choose a loan that aligns with your budget and goals. Best of all, it’s a free, quick way to gain insight before meeting with lenders.